In recent years, a new paradigm has emerged in the insurance industry known as peer-to-peer (P2P) insurance. This innovative approach shifts the traditional insurance model by fostering community-based coverage, where individuals come together to share risks collectively. P2P insurance offers a refreshing alternative to conventional insurance, emphasizing trust, transparency, and community involvement.

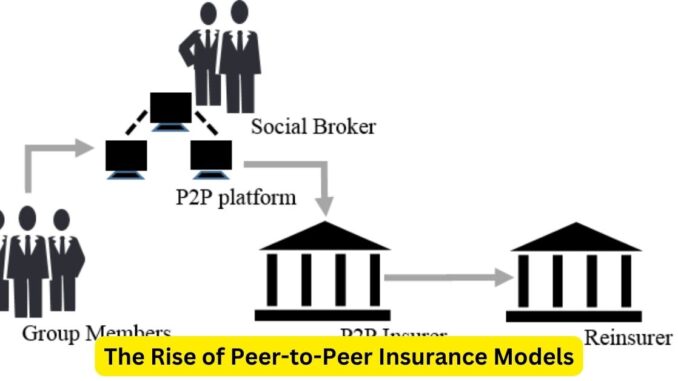

At the core of P2P insurance lies the concept of shared responsibility within a community. Instead of paying premiums to a centralized insurer, individuals join a pool of peers with similar risks. These groups, or “pools,” contribute premiums into a collective fund, which is utilized to cover claims within the community.

The strength of P2P insurance lies in its emphasis on mutual support and risk-sharing among peers. This model promotes a sense of belonging and solidarity, as individuals within the community share common interests and goals. Members often have a say in how the pool operates, fostering a sense of ownership and control over their insurance coverage.

Moreover, P2P insurance promotes transparency and fairness. Members can witness firsthand where their premiums are allocated and how claims are processed within the community. This transparency builds trust and confidence in the system, unlike the opacity often associated with traditional insurance companies.

One of the significant advantages of P2P insurance is its potential to reduce moral hazards and fraudulent claims. Since members of the pool are connected by a sense of social responsibility, there’s a natural inclination to act responsibly to prevent unnecessary claims, as they directly impact the community’s resources.

However, P2P insurance isn’t without challenges. Scaling these models while maintaining financial stability and ensuring adequate coverage for all members remains a hurdle. Balancing the risk exposure across diverse communities and managing fluctuations in claim volumes requires robust risk assessment and financial planning.

Additionally, regulatory frameworks may pose challenges for P2P insurance, as they often differ from traditional insurance regulations. Adhering to regulatory standards while preserving the community-centric nature of P2P models necessitates navigating a complex landscape of compliance.

Despite these challenges, the potential for P2P insurance to reshape the insurance landscape is significant. Its community-driven ethos aligns with the shifting preferences of consumers who seek more personalized, participatory, and transparent insurance experiences.

As technology continues to evolve, P2P insurance is poised to leverage digital platforms and blockchain technology to streamline operations, enhance trust, and expand its reach. These technological advancements can facilitate the efficient management of pools, automate claims processing, and provide a seamless user experience for members.

In conclusion, peer-to-peer insurance represents a refreshing departure from the traditional insurance landscape, emphasizing community collaboration, trust, and transparency. While facing challenges in scalability and regulatory compliance, its potential to create more inclusive, customer-centric insurance models is driving innovation within the industry. As these models evolve and adapt, they hold the promise of reshaping the insurance sector by putting the power of coverage back into the hands of the communities they serve.

Leave a Reply