Insurance plays a pivotal role in the journey towards achieving financial well-being. It serves as a safety net, protecting individuals and families from unexpected financial burdens that could otherwise derail their plans and aspirations. Embracing the concept of insured living entails understanding the importance of various types of insurance coverage and integrating them into your financial strategy to build resilience and security for the future.

At the heart of insured living is health insurance, which provides essential coverage for medical expenses and healthcare services. By having health insurance in place, individuals can access timely medical care without the fear of being overwhelmed by exorbitant bills. Whether it’s routine check-ups, emergency treatments, or specialized procedures, health insurance ensures that health-related costs do not compromise financial stability. Moreover, with preventive care and wellness programs often included in health insurance plans, individuals can proactively manage their health, reducing the likelihood of future medical expenses.

Homeowners insurance is another pillar of insured living, safeguarding one of the most significant investments—the home. This coverage protects against various risks, including damage to the property and belongings due to fire, theft, or natural disasters. Homeowners insurance not only provides financial reimbursement for repairs or replacements but also offers liability protection in case of accidents or injuries on the premises. By securing adequate homeowners insurance, individuals can protect their homes and belongings, ensuring peace of mind and stability for their families.

Auto insurance is essential for those who rely on vehicles for transportation. Accidents happen unexpectedly, and auto insurance provides financial protection against vehicle damages, injuries, or liability claims that may arise. With a range of coverage options available, including liability, collision, and comprehensive coverage, individuals can tailor their auto insurance policies to suit their needs and budget. Additionally, discounts and incentives offered by insurers can help individuals save on premiums while maintaining adequate coverage.

Life insurance forms a critical component of insured living, providing a safety net for loved ones in the event of the policyholder’s death. Life insurance proceeds can be used to cover funeral expenses, pay off debts, replace lost income, or fund future financial goals such as education or retirement. By securing life insurance coverage, individuals can ensure that their families are protected financially, allowing them to navigate life’s challenges with confidence and stability.

In addition to personal insurance, business owners must also prioritize insurance as part of their financial planning. Business insurance protects against various risks and liabilities that could threaten the continuity of operations, including property damage, liability claims, and business interruptions. By securing comprehensive business insurance coverage, entrepreneurs can safeguard their investments and livelihoods, ensuring the long-term success and resilience of their ventures.

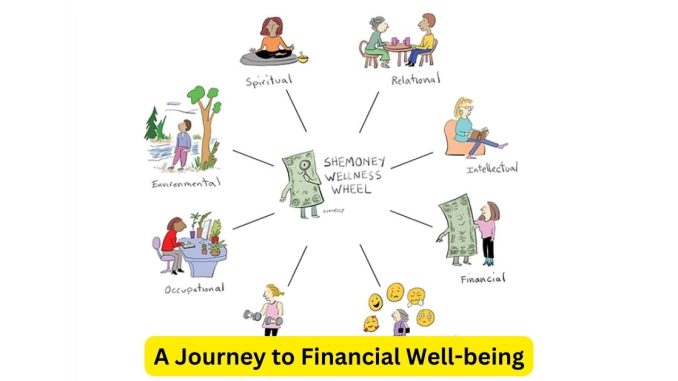

In conclusion, insured living is a journey towards financial well-being, characterized by the integration of various types of insurance coverage into one’s financial strategy. By understanding the importance of health, homeowners, auto, life, and business insurance and securing adequate coverage in each area, individuals and families can build resilience, protect their assets, and achieve greater peace of mind. Insured living is not just about mitigating risks—it’s about empowering individuals to pursue their goals and aspirations with confidence, knowing that they have a safety net in place to protect against life’s uncertainties.

Leave a Reply