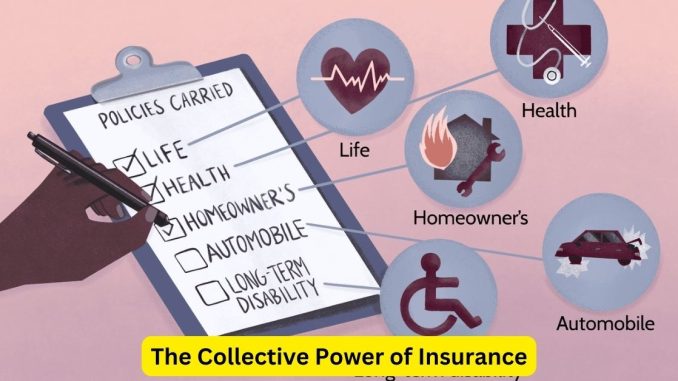

Insurance operates on a fundamental principle: pooling resources to provide financial protection against unforeseen risks. This collective approach to risk management not only spreads the burden but also harnesses the power of solidarity. Here’s a closer look at how the collective nature of insurance offers safety in numbers:

Risk Pooling

At its core, insurance relies on the concept of risk pooling, where individuals facing similar risks contribute premiums to a common pool. By spreading the financial risk among a large group of policyholders, insurance companies can effectively manage the costs associated with claims. This ensures that no single policyholder bears the full burden of a catastrophic loss, promoting financial stability and peace of mind for all.

Shared Responsibility

Insurance encourages a sense of shared responsibility among policyholders. By participating in the insurance pool, individuals acknowledge their role in supporting others facing similar risks. This collective responsibility fosters a sense of community and solidarity, emphasizing the importance of looking out for one another’s well-being.

Affordability and Accessibility

The collective nature of insurance helps make coverage more affordable and accessible to a broader range of individuals. By spreading the costs of insurance across a large group, premiums remain manageable for policyholders while still providing comprehensive coverage. This affordability ensures that essential insurance protections, such as health insurance or homeowners’ insurance, are within reach for more people, regardless of their financial means.

Risk Mitigation and Stability

Insurance plays a crucial role in mitigating risks and promoting stability in various aspects of life. Whether it’s protecting against property damage, medical expenses, or liability claims, insurance provides a safety net that helps individuals and businesses navigate uncertain times. The collective pooling of resources ensures that adequate funds are available to cover unexpected losses, preventing financial crises and fostering economic resilience.

Innovation and Adaptation

The collective power of insurance also drives innovation and adaptation within the industry. Insurers continuously assess emerging risks and develop new products to address evolving needs. By leveraging data analytics and risk modeling techniques, insurers can better understand and anticipate future challenges, ensuring that insurance coverage remains relevant and effective in an ever-changing world.

Community Support and Recovery

In times of adversity, insurance serves as a lifeline for communities facing hardship. Whether it’s rebuilding after a natural disaster or providing financial support during a health crisis, insurance helps communities recover and rebuild stronger than before. The collective resources pooled through insurance enable swift response and assistance, demonstrating the power of solidarity in times of need.

In conclusion, the collective nature of insurance embodies the principle of “safety in numbers,” where individuals come together to share risks, responsibilities, and resources. By pooling resources and spreading risks across a larger group, insurance promotes affordability, accessibility, stability, and innovation while fostering a sense of community support and solidarity. Embracing the collective power of insurance ensures that individuals and communities alike can navigate life’s uncertainties with confidence and resilience.

Leave a Reply