Mortgage recasting, also known as re-amortization, is a process that allows homeowners to adjust their monthly mortgage payments by applying a lump sum payment to the principal balance of the loan. While recasting can offer financial benefits, it also carries legal implications that homeowners and attorneys should understand. Here’s a detailed exploration of the legal aspects associated with mortgage recasting:

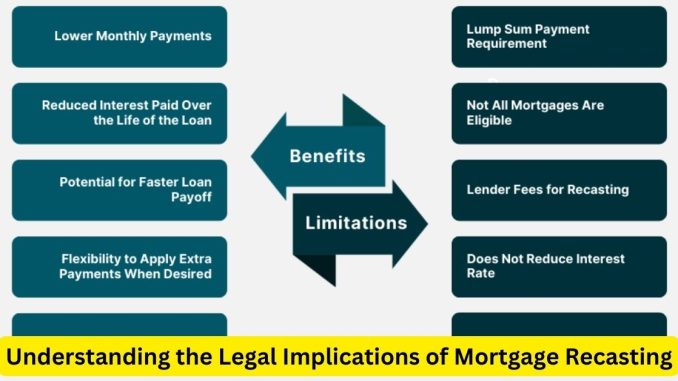

- Impact on Loan Terms: When homeowners recast their mortgage, the principal balance of the loan decreases, which can result in a lower monthly payment. However, it’s essential to note that recasting typically does not alter the interest rate or the overall terms of the loan. Homeowners should review their loan agreement to ensure that recasting does not trigger any unintended consequences or penalties.

- Lender Approval: Mortgage recasting typically requires approval from the lender. Homeowners must follow the lender’s specific procedures and guidelines for initiating the recasting process. Attorneys can assist homeowners in navigating the recasting requirements outlined in their loan agreement and ensure compliance with lender policies.

- Documentation and Fees: Lenders may require homeowners to provide documentation of the lump sum payment and pay a recasting fee to initiate the process. Attorneys can review the recasting documentation to ensure that all terms and conditions are accurately reflected and that homeowners understand their obligations regarding fees and documentation requirements.

- Impact on Loan Servicing: Mortgage recasting may impact the loan servicing arrangements between homeowners and their mortgage servicers. Changes to the monthly payment amount or the loan balance may require updates to the loan servicing agreement. Attorneys can review the loan servicing agreement to assess any potential implications of recasting on servicing arrangements and ensure that homeowners are fully informed.

- Legal Protections: Homeowners are entitled to certain legal protections when pursuing mortgage recasting. These protections may include the right to receive accurate and transparent disclosures regarding the recasting process, fees, and any changes to loan terms. Attorneys can advocate for homeowners’ rights and ensure that lenders comply with applicable laws and regulations governing mortgage recasting.

- Impact on Credit Report: Mortgage recasting may have implications for homeowners’ credit reports. While recasting itself does not typically have a direct impact on credit scores, changes to the loan balance or payment history may affect credit reporting. Attorneys can advise homeowners on how recasting may impact their credit and provide guidance on mitigating any negative effects.

- Potential Legal Risks: Homeowners should be aware of potential legal risks associated with mortgage recasting, including the risk of default if they are unable to maintain the new, lower monthly payments. Attorneys can assess the legal risks involved in recasting and advise homeowners on strategies for mitigating risk, such as budgeting for potential changes in financial circumstances.

- Disclosure Requirements: Lenders have a legal obligation to provide homeowners with accurate and comprehensive disclosures regarding mortgage recasting. Attorneys can review the recasting disclosures to ensure that homeowners understand the implications of recasting and their rights and responsibilities under the new loan terms.

In conclusion, mortgage recasting offers homeowners a way to adjust their monthly mortgage payments by applying a lump sum payment to the principal balance of the loan. However, it’s essential for homeowners to understand the legal implications of recasting and seek guidance from attorneys to navigate the process effectively while protecting their rights and interests.

Leave a Reply