In an era where digital transformation is reshaping industries, blockchain technology stands out as a game-changer in revolutionizing insurance transactions. Coupled with smart contracts, blockchain offers a decentralized, transparent, and secure platform that holds immense potential for transforming the insurance landscape.

At its core, blockchain is a distributed ledger technology that allows for the creation of an immutable record of transactions across a network of computers. In the realm of insurance, this means a transparent and tamper-proof system for recording policies, claims, and settlements. The decentralized nature of blockchain eliminates the need for intermediaries, reducing administrative costs and enhancing efficiency.

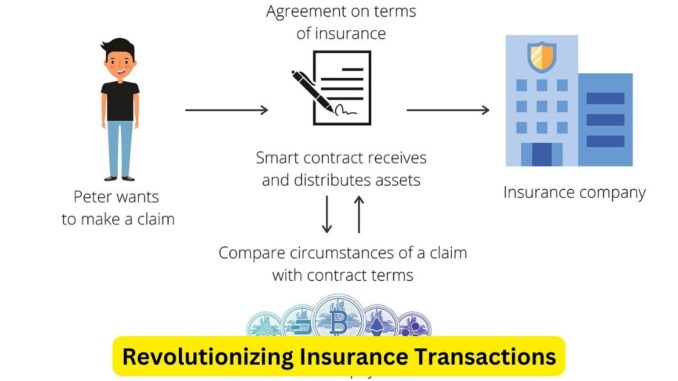

Smart contracts, powered by blockchain, are self-executing contracts with the terms of the agreement directly written into code. These contracts automatically execute and enforce themselves when predefined conditions are met. In insurance, this translates to automated claims processing and payments, triggered by predefined events such as flight delays, weather-related damages, or healthcare treatments.

One of the most significant benefits of blockchain in insurance lies in enhancing transparency and reducing fraud. The immutable nature of blockchain records ensures that all transactions are visible to authorized parties, minimizing the risk of fraudulent claims. Moreover, the use of smart contracts automates the claims process, ensuring that payments are made promptly and accurately once the conditions are met, reducing delays and potential disputes.

Additionally, blockchain technology enables the creation of parametric insurance products. These products use predefined parameters, such as weather data or IoT (Internet of Things) sensors, to trigger automatic payouts when specific conditions are met. For instance, in agriculture, blockchain-based parametric insurance can swiftly compensate farmers in the event of adverse weather conditions affecting their crops without the need for time-consuming claims assessments.

However, the widespread adoption of blockchain in insurance faces certain challenges. Interoperability and standardization across different blockchain platforms remain a hurdle. To maximize its potential, the industry needs to converge on common standards that allow seamless integration and data sharing among various stakeholders.

Moreover, concerns about data privacy and regulatory compliance persist. Ensuring that sensitive customer information is protected while adhering to evolving regulations poses a significant challenge for insurers leveraging blockchain technology.

Despite these challenges, the integration of blockchain and smart contracts into the insurance sector represents a transformative step towards efficiency, transparency, and customer satisfaction. As the technology matures and industry-wide collaboration increases, the potential for blockchain to streamline insurance processes and reshape the way policies are underwritten, claims are processed, and contracts are executed becomes increasingly evident.

Leave a Reply