The landscape of auto insurance is undergoing a seismic shift, courtesy of telematics technology. Traditionally, insurance rates were based on statistical data, demographics, and generalizations about drivers. However, the advent of telematics has revolutionized this approach, allowing for personalized and more accurate pricing based on individual driving behaviors.

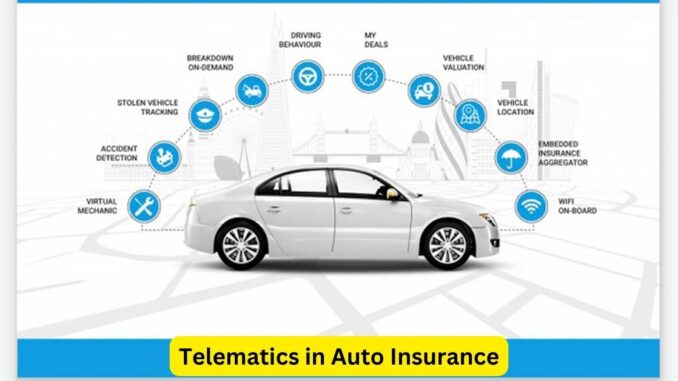

Telematics utilizes a blend of telecommunications and informatics to collect real-time data about a driver’s habits and performance behind the wheel. This information is gathered through devices installed in vehicles or via smartphone apps that track driving patterns, including speed, braking habits, acceleration, mileage, and even the time of day a vehicle is in use.

The beauty of telematics lies in its ability to create a comprehensive profile of a driver’s behavior rather than relying on statistical averages. For example, a driver who maintains safe speeds, practices smooth braking, and avoids driving during high-risk hours might be rewarded with lower premiums compared to someone with riskier driving habits, even if they belong to the same age group or live in the same area.

This shift towards usage-based insurance, enabled by telematics, is a win-win for both insurers and policyholders. Insurers can accurately assess risk, potentially reducing losses and improving profitability. Simultaneously, safe drivers have the opportunity to enjoy discounted rates, incentivizing and encouraging responsible driving practices.

Moreover, telematics doesn’t solely focus on determining premiums. It also promotes safer driving behaviors. Being aware that their driving habits are being monitored often leads individuals to become more cautious and mindful behind the wheel, ultimately reducing the frequency of accidents and promoting road safety.

However, there are challenges associated with the adoption of telematics in auto insurance. Privacy concerns are paramount among consumers who may be wary of constant monitoring of their driving behaviors. Striking a balance between data collection for insurance purposes and respecting individuals’ privacy remains a crucial aspect that insurers need to address transparently.

Additionally, while telematics predominantly rewards safe driving, it may not account for external factors affecting driving behavior, such as road conditions or the actions of other drivers. Therefore, refining these systems to accurately differentiate between factors within and beyond the driver’s control is an ongoing challenge.

Despite these challenges, the trajectory of telematics in auto insurance is undoubtedly upward. As technology advances and more data is gathered and analyzed, the potential for even more personalized and accurate pricing models becomes increasingly promising. The integration of telematics isn’t just transforming insurance rates; it’s reshaping the entire auto insurance industry, paving the way for a more fair, transparent, and safer driving environment.

Leave a Reply