As the impacts of climate change intensify, the need for effective strategies to mitigate and adapt to its consequences becomes increasingly pressing. Climate risk insurance emerges as a crucial tool in helping individuals, communities, and businesses cope with the growing threats posed by extreme weather events, rising sea levels, and other climate-related hazards.

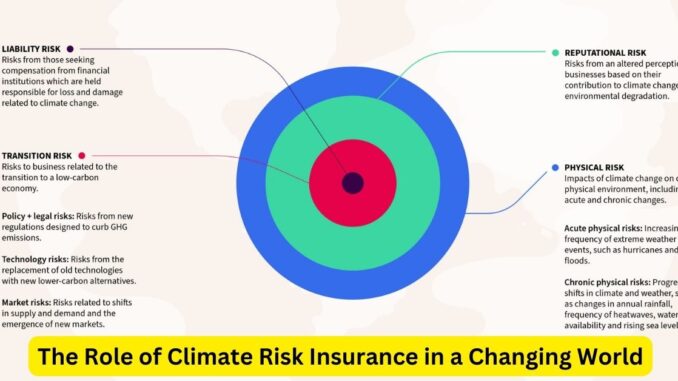

Climate change brings forth a plethora of risks, including more frequent and severe natural disasters such as hurricanes, floods, wildfires, and droughts. These events not only result in immediate physical damages but also disrupt livelihoods, economies, and infrastructure. Climate risk insurance plays a pivotal role in providing financial protection against these unpredictable events.

One of the fundamental aspects of climate risk insurance is its focus on pre-emptive measures and risk reduction. Insurers work alongside governments and communities to incentivize and support investments in resilient infrastructure, early warning systems, and adaptation measures. This proactive approach helps minimize potential damages and losses, ultimately reducing the overall impact of climate-related disasters.

Moreover, climate risk insurance facilitates rapid recovery and reconstruction in the aftermath of climate-related catastrophes. It enables timely payouts and support, allowing affected individuals and businesses to rebuild and recover more swiftly, thus fostering resilience in the face of adversity.

The significance of climate risk insurance extends beyond immediate relief to long-term sustainability. Insurers are increasingly emphasizing sustainable practices and incentivizing environmentally friendly initiatives. They offer coverage for renewable energy projects, green infrastructure, and sustainable agriculture, fostering a shift toward more climate-resilient practices.

However, there are challenges in implementing climate risk insurance effectively. Estimating and pricing climate-related risks accurately remains a complex task due to the evolving nature of climate change and its uncertainties. Insurers must continuously innovate and collaborate with climate scientists and policymakers to refine risk assessment models and ensure comprehensive coverage.

Furthermore, ensuring accessibility and affordability of climate risk insurance for vulnerable communities and developing regions is imperative. Initiatives to make insurance premiums affordable and accessible for those most at risk from climate-related events are crucial for fostering resilience across all strata of society.

Governments, international organizations, insurers, and communities must collaborate to overcome these challenges. By fostering partnerships and encouraging innovative solutions, such as parametric insurance that triggers payouts based on predefined weather parameters, the efficacy and reach of climate risk insurance can be enhanced.

In conclusion, climate risk insurance stands as a vital instrument in building resilience and adapting to the escalating challenges posed by climate change. Its ability to provide financial protection, promote risk reduction, and incentivize sustainable practices is indispensable in navigating a future where climate-related risks are increasingly prominent. By embracing and expanding climate risk insurance, societies can bolster their capacity to withstand and recover from the impacts of a changing environment.

Leave a Reply