In the realm of insurance, understanding human behavior and decision-making is as crucial as evaluating risks and calculating premiums. Behavioral economics, a field that melds psychology and economics, offers valuable insights into the way individuals make choices regarding insurance, shaping strategies and policies to better align with human behavior.

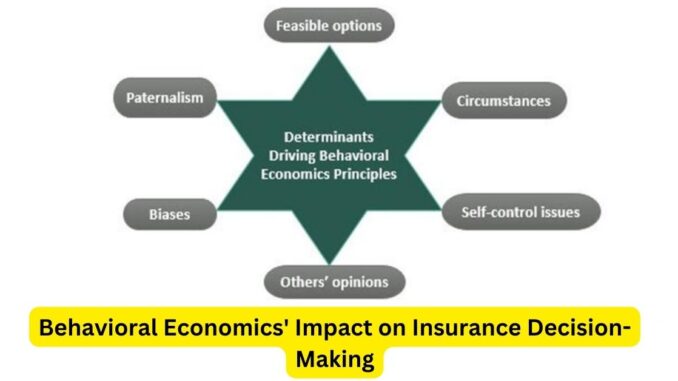

Traditional economic models often assume rational decision-making, but behavioral economics reveals that human decisions are influenced by cognitive biases, emotions, and heuristics. When it comes to insurance, these behavioral traits significantly impact how individuals perceive, purchase, and utilize insurance products.

One prominent bias is loss aversion, where individuals tend to weigh potential losses more heavily than equivalent gains. This bias influences insurance decisions, making individuals more inclined to purchase insurance to protect against potential losses rather than opting for gains or benefits they might receive.

The concept of present bias illustrates how individuals prioritize immediate gratification over long-term benefits. This bias often leads to underestimating future risks and neglecting the importance of comprehensive insurance coverage until faced with an imminent threat.

Moreover, the status quo bias manifests in a reluctance to change existing insurance policies even when better options are available. This bias results in individuals sticking to familiar plans rather than exploring potentially more suitable or cost-effective alternatives.

Understanding these behavioral tendencies allows insurers to craft strategies that cater to customers’ psychological inclinations. Simplifying insurance plans, framing information to highlight potential losses, offering immediate benefits, and providing nudges toward better coverage options can align insurance offerings more closely with human decision-making.

Behavioral economics also sheds light on the significance of how information is presented. The concept of choice architecture emphasizes the impact of how choices are framed and presented. Insurers can leverage this knowledge by presenting insurance options in a clear, easy-to-understand manner, guiding customers toward informed decisions.

Furthermore, the use of behavioral insights extends to encouraging positive behaviors through incentives. Insurers employ behavioral “nudges” such as discounts for safe driving habits or wellness programs to promote healthier lifestyles. These incentives not only benefit customers but also reduce risks for insurers, creating a win-win situation.

However, ethical considerations are paramount when applying behavioral economics in insurance. Insurers must ensure transparency, avoid exploitation of biases, and uphold principles of fairness and consumer protection.

In conclusion, behavioral economics offers a profound understanding of human decision-making in the realm of insurance. By acknowledging and accounting for cognitive biases, emotions, and heuristics, insurers can design more customer-centric policies, enhance decision-making processes, and foster a more harmonious relationship between insurance offerings and the behavioral inclinations of customers. This integration fosters a landscape where insurance decisions are better aligned with human behavior, promoting informed choices and improved risk management.

Leave a Reply