Insurance is a financial safeguard that plays a vital role in protecting you from unforeseen circumstances. While the concept of insurance may seem complex, breaking it down into simple terms can make it more accessible. Here are tips to simplify the often-confusing world of insurance, helping you understand the basics with ease.

- Start with the Basics: Begin by grasping the fundamental types of insurance. Health, life, auto, home, and disability insurance are common categories. Each type serves a specific purpose, providing coverage for different aspects of your life.

- Understand the Purpose: Insurance is essentially a risk management tool. It exists to help you mitigate the financial impact of unexpected events, such as accidents, illnesses, or property damage. Recognizing this purpose can demystify the seemingly intricate nature of insurance.

- Break Down the Jargon: Insurance policies often come with a barrage of industry-specific terms. Take the time to break down the jargon and understand what each term means. Key terms include premiums (cost of insurance), deductibles (amount paid before coverage kicks in), and coverage limits (maximum amount the insurance pays).

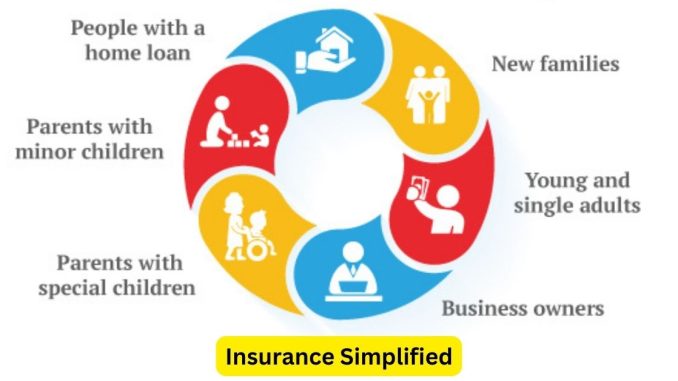

- Identify Your Needs: Not every insurance type is necessary for everyone. Identify your specific needs and circumstances. For example, if you have a family, life insurance might be a priority, while renters may focus on renter’s insurance for personal belongings.

- Explore Coverage Options: Each type of insurance comes with different coverage options. When considering a policy, explore the available options to tailor coverage to your specific needs. For instance, auto insurance may include liability, collision, and comprehensive coverage.

- Consider Costs and Budget: Understanding the cost of insurance is crucial. Premiums vary based on factors such as coverage amount, deductibles, and your risk profile. Balance the costs with your budget to ensure you can comfortably afford the coverage you need.

- Compare Quotes: Insurance providers offer different rates for similar coverage. Take advantage of this by comparing quotes from multiple insurers. This simple step can help you find the best value for your money.

- Regularly Review Policies: Life is dynamic, and your insurance needs may change over time. Regularly review your policies to ensure they still align with your current situation. Life events like marriage, the birth of a child, or purchasing a home may warrant adjustments to your coverage.

- Ask Questions: Don’t hesitate to ask questions when seeking insurance. Insurance agents and representatives are there to help you understand the policies better. Clarifying any uncertainties ensures you make well-informed decisions.

In conclusion, insurance doesn’t have to be intimidating. By breaking down the basics, understanding the purpose, and tailoring coverage to your needs, you can simplify the world of insurance. Take the time to explore options, compare quotes, and regularly review your policies to ensure your coverage aligns with your evolving circumstances. With these tips, you can navigate the insurance landscape with confidence and ease.

Leave a Reply