Navigating the world of insurance can be a daunting task, but with the right roadmap, you can confidently explore the myriad coverage options available. Understanding the basics of insurance is crucial for making informed decisions that align with your needs. Let’s embark on a journey through the key aspects of insurance to help demystify this essential financial tool.

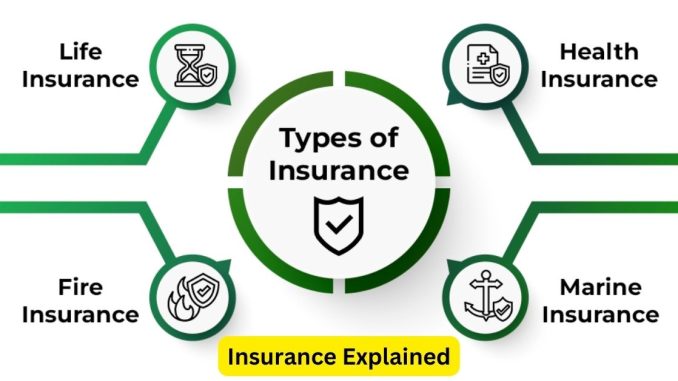

- Types of Insurance: Insurance comes in various forms, each serving a specific purpose. Common types include health, life, auto, home, and disability insurance. Familiarize yourself with the different categories to identify which ones are most relevant to your situation.

- Health Insurance: Your well-being is a top priority, making health insurance a fundamental choice. It typically covers medical expenses, including hospital visits, prescription medications, and preventive care. Understanding the coverage limits, premiums, and network providers is crucial for selecting the right health insurance plan.

- Life Insurance: Life insurance provides financial protection for your loved ones in the event of your death. It comes in various forms, including term life and whole life insurance. Consider factors such as the coverage amount, duration, and premiums when choosing a life insurance policy.

- Auto Insurance: If you own a vehicle, auto insurance is mandatory in many places. It offers protection in case of accidents, theft, or damage to your car. Evaluate coverage options such as liability, collision, and comprehensive to tailor your policy to your specific needs.

- Home Insurance: Home insurance safeguards your property against perils like fire, theft, and natural disasters. Policies often include coverage for both the structure and your belongings. Assess the replacement cost, deductible, and additional coverage options to tailor your policy to your home’s unique features.

- Disability Insurance: Disability insurance provides income protection if you are unable to work due to illness or injury. Understanding the waiting period, benefit period, and coverage limits is crucial for ensuring financial stability during challenging times.

- Premiums, Deductibles, and Coverage Limits: Key components of insurance policies include premiums (the cost of coverage), deductibles (the amount you pay out of pocket before insurance kicks in), and coverage limits (the maximum amount the insurance will pay). Balancing these factors is essential for finding a policy that meets your financial comfort level.

- Comparison Shopping: Don’t settle for the first insurance quote you receive. Comparison shopping allows you to explore different providers, their reputation, and the value they offer. This proactive approach ensures you get the best coverage at a competitive price.

In conclusion, insurance is a crucial tool for protecting yourself, your loved ones, and your assets. By understanding the various types of insurance and key policy features, you can confidently navigate the insurance landscape. Remember to regularly review and update your coverage to adapt to life’s changes and ensure ongoing protection for the road ahead.

Leave a Reply