In an unpredictable world, securing your future involves making thoughtful decisions about insurance coverage. From safeguarding your health to protecting your assets, insurance plays a crucial role in providing financial stability. To help you navigate the complex landscape of insurance, here are expert tips to ensure you make smart coverage choices.

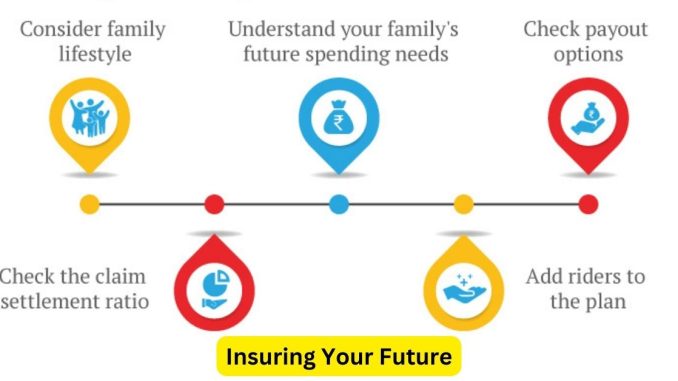

- Assess Your Needs: Before diving into insurance options, take a comprehensive look at your current and future needs. Consider factors such as your health, lifestyle, dependents, and financial obligations. Understanding your specific requirements will guide you in choosing the most relevant coverage.

- Health Insurance is Non-Negotiable: Your health is your most valuable asset, making health insurance a top priority. Evaluate different health insurance plans, considering coverage limits, deductibles, and network providers. Be proactive in securing a plan that not only fits your budget but also provides adequate coverage for potential medical expenses.

- Diversify Your Coverage: Instead of relying on a single insurance policy, consider diversifying your coverage. Explore options such as life insurance, disability insurance, and property insurance. A well-rounded insurance portfolio ensures that you are protected in various aspects of your life.

- Regularly Review Policies: Life is dynamic, and so are your insurance needs. Regularly review your insurance policies to ensure they align with your current circumstances. Life events such as marriage, childbirth, or purchasing a home may necessitate adjustments to your coverage.

- Shop Around for the Best Rates: Insurance rates can vary significantly among providers. Take the time to shop around and compare quotes from different insurance companies. While cost is a crucial factor, also consider the reputation and customer service of the insurance provider.

- Understand Policy Terms: Insurance policies can be laden with complex terms and conditions. Take the time to thoroughly understand the terms of your policy, including coverage limits, exclusions, and renewal conditions. Clear comprehension will prevent surprises and ensure you make the most of your coverage when needed.

- Consider the Deductible: Evaluate the deductible associated with your insurance policies. A higher deductible often translates to lower premiums, but it also means you’ll have to pay more out of pocket before your coverage kicks in. Strike a balance that suits your financial situation.

- Emergency Fund as a Complement: While insurance is crucial, having an emergency fund can act as a complementary safety net. Reserve funds can cover unexpected expenses or deductibles, ensuring that you are not solely reliant on insurance for financial protection.

By following these expert tips, you can make informed decisions to secure your future through smart insurance coverage. Remember, the key lies in understanding your needs, staying informed, and regularly reassessing your coverage to adapt to life’s changes. With the right approach, you can build a robust insurance portfolio that safeguards your well-being and financial stability.

Leave a Reply