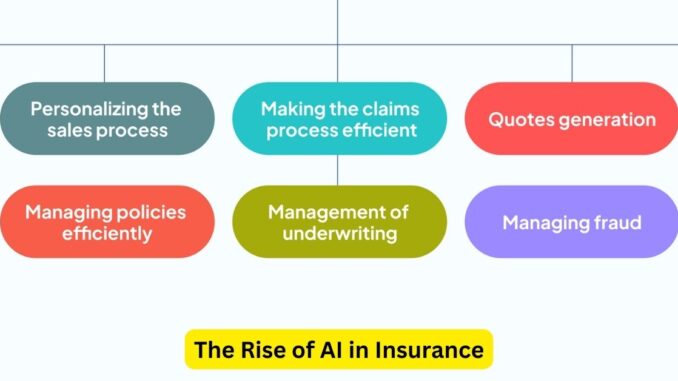

Artificial Intelligence (AI) is revolutionizing the landscape of insurance customer service, offering a paradigm shift in how insurers interact with their clients. The integration of AI-powered solutions is not merely a technological leap but a strategic move toward enhancing efficiency, personalization, and overall customer experience in the insurance industry.

AI-driven chatbots and virtual assistants have become stalwarts in insurance customer service. These intelligent systems leverage natural language processing and machine learning to interact with customers, providing instant support for queries related to policy information, claims processing, and general assistance. The immediacy and round-the-clock availability of these AI-driven assistants significantly improve customer responsiveness.

Moreover, AI’s predictive analytics capabilities empower insurers to anticipate customer needs and behaviors. By analyzing vast datasets, AI algorithms can offer personalized recommendations, suggest appropriate coverage options, and even predict potential risks, enabling insurers to proactively address customer concerns.

Claims processing, traditionally a cumbersome and time-consuming task, undergoes a transformative change with AI. Machine learning algorithms can efficiently assess claims, detect fraud patterns, and expedite the approval process, leading to quicker settlements and improved customer satisfaction.

The integration of AI in customer service doesn’t seek to replace human agents but rather augments their capabilities. AI frees up human agents from routine queries, allowing them to focus on more complex customer issues that require empathy, creativity, and nuanced decision-making—areas where human touch remains irreplaceable.

Ethical considerations and data privacy are paramount in the use of AI in insurance customer service. Insurers must uphold strict guidelines and transparency in handling sensitive customer data. Furthermore, AI algorithms must be continuously monitored and audited to ensure fairness, mitigate biases, and uphold ethical standards in decision-making processes.

As AI technology evolves, insurers are exploring new frontiers, such as AI-driven personalized pricing models based on individual behaviors and risk profiles. However, regulators are keeping a close eye on these advancements to ensure they align with ethical standards and avoid discriminatory practices.

Customer trust and satisfaction are pivotal in the insurance industry. AI, when wielded responsibly, enhances these aspects by offering efficient, personalized, and responsive customer service experiences. Insurers that effectively leverage AI technology stand to gain a competitive edge by providing superior customer-centric solutions.

In conclusion, AI is not just a technological marvel but a game-changer in the realm of insurance customer service. Its ability to streamline processes, personalize interactions, and optimize decision-making heralds a new era of customer-centricity in the insurance industry. Responsible integration of AI ensures a harmonious synergy between technological advancements and ethical considerations, paving the way for a future where customer service in insurance reaches new heights of efficiency and personalization.

Leave a Reply